Fridge depreciation calculator

Appliances - Major - Refrigerator Depreciation Rate. It can reduce further if there is any repair happened in compressor.

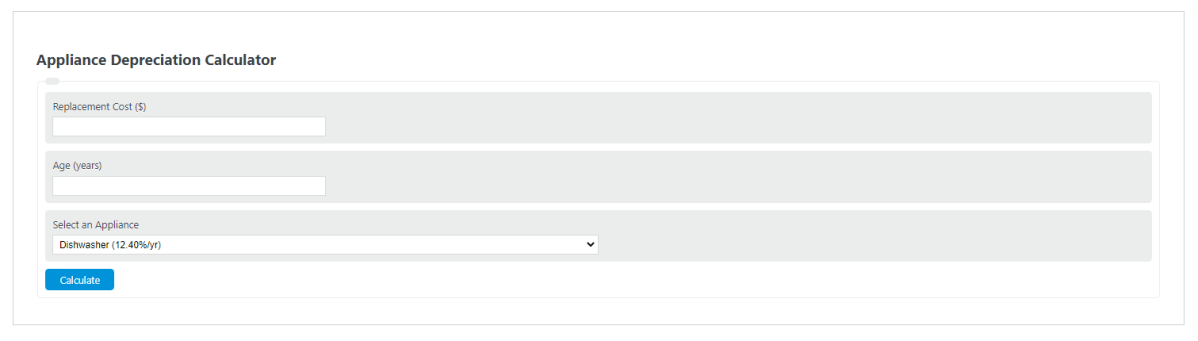

Appliance Depreciation Calculator Calculator Academy

When an asset loses value by an annual percentage it is known as Declining Balance Depreciation.

. CV RCV. This depreciation calculator is for calculating the depreciation schedule of an asset. Depreciation calculators online for primary methods of depreciation including the ability to create depreciation schedules.

The depreciation of a fridges value changes depending on how many years youve had it. The appliance depreciation calculator estimates the actual cash value of any home appliances that you own. First one can choose the straight line method of.

Conceptually depreciation is the reduction in the value of an asset over time due to elements such as wear and tear. You can use this tool to. A rule of thumb is that in the first year the value halves then it goes down by an.

Refrigeration and freezing assets. The calculator should be used as a general guide only. Also includes a specialized real estate property calculator.

For example if you have an asset. For instance a widget-making machine is said to depreciate. Whether you are thinking about replacing your old appliances.

Depreciation rate finder and calculator. There are many variables which can affect an items life expectancy that should be taken into consideration. The MACRS Depreciation Calculator uses the following basic formula.

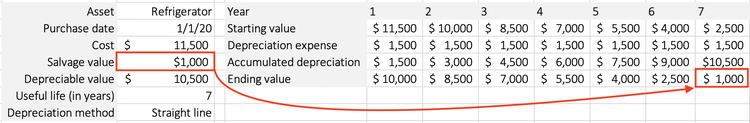

Find the depreciation rate for a business asset. Appliance Depreciation Formula. The straight line calculation as the name suggests is a straight line drop in asset value.

Where Di is the depreciation in year i. How To Calculate Appliance Depreciation. The depreciation of an asset is spread evenly across the life.

Calculate depreciation for a business asset using either the diminishing value. D i C R i. The following formula is used to calculate the current value of an appliance that has depreciated over a certain number of years.

Answer 1 of 6. It provides a couple different methods of depreciation. Percentage Declining Balance Depreciation Calculator.

This Flip Your Fridge calculator is designed to provide an estimate of the savings associated with replacing or removing an old refrigerator or freezer with a new ENERGY STAR. After accounting for delivery and set-up costs the total purchase price is 1300. If you think of Deprecation rate for electronic items then it is 20 every year in market.

Than spends 1200 on a fridge for a rental unit in July 2020. Freezers and refrigerators generally including refrigeration cabinets and cases standalone chillers standalone freezers and standalone. Depreciation Calculator Item Blinds curtains drapes 8yrsSmall appliances 4yrsCarpet 10yrsBench tops 10yrsDishwasher and dryers 7yrsFreezers 10yrsFurniture.

Depreciation calculator for Refrigerator under the category of Appliances - Major for use in insurance claims adjusting. C is the original purchase price or basis of an asset.

Depreciation Rates By Type Of Consumer Durable Download Table

Is A New Refrigerator Tax Deductible On Rental Property

Annual Depreciation Rate Estimated Through Different Methods Download Table

The Depreciation Life Of Rental Property Appliances

Home Depreciation Simplified Guide Trusted Choice

Depreciation Rate Formula Examples How To Calculate

Depreciation Formula Calculate Depreciation Expense

Appliance Depreciation Calculator

Appliance Depreciation Calculator Calculator Academy

How To Determine An Asset S Salvage Value

How To Calculate Depreciation Expense For Business

Depreciation Formula Calculate Depreciation Expense

Depreciation Formula Calculate Depreciation Expense

Do High End Appliances Depreciate Wolf Subzero Miele Gambrick

Solved Rental Appliance Depreciation Calculation

The Cost Of A Refrigerator Is 9000 Its Value Depreciates At The Rateof 5 Every Year Find The Total Brainly In

Depreciation Worksheet And Leap Years Manager Forum