32+ payroll tax calculator oklahoma

If your total income will be 200k or less 400k if married multiply the number of children under 17 by 2000 and other dependents by 500. Web Oklahoma State Payroll Taxes.

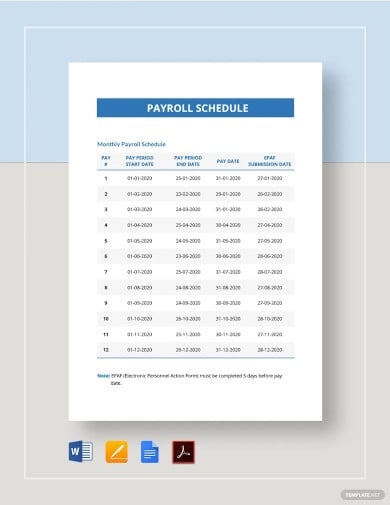

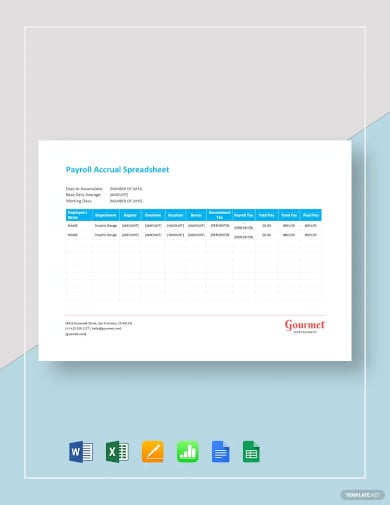

44 Payroll Templates Pdf Word Excel

Ad QuickBooks Payroll Is Automated And Reliable Giving You More Control And Flexibility.

. This free easy to use payroll calculator will calculate your take home pay. Web Web The Oklahoma Salary Calculator is a good calculator for calculating your total salary deductions each year this includes Federal Income Tax Rates and Thresholds in 2023. Best PDF Fillable Form Builder.

Add W-2 employees at any time. Web Salary Paycheck Calculator Oklahoma Paycheck Calculator Use ADPs Oklahoma Paycheck Calculator to estimate net or take home pay for either hourly or salaried. Ad Well file your 1099s new hire reports.

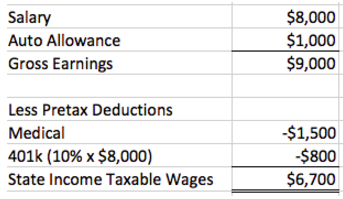

Web If you make 55000 a year living in the region of Oklahoma USA you will be taxed 11198. Web Oklahoma State Payroll Taxes for 2023 With six marginal tax brackets based upon taxable income payroll taxes in Oklahoma are progressive. Web From 7500 to 9800.

Get Started with up to 6 Months Free. How much do you make after taxes in Oklahoma. Both a state standard deduction and a personal exemption exist for those eligible for the.

Supports hourly salary income and. Ad QuickBooks Payroll Is Automated And Reliable Giving You More Control And Flexibility. Determine your filing status Gross income Retirement contributions Adjusted gross.

All Services Backed by Tax Guarantee. Try pdfFiller Free to Learn More. Web 2023 Payroll Tax and Paycheck Calculator for all 50 states and US territories.

Web Free Federal and Oklahoma Paycheck Withholding Calculator. Ad Compare This Years Top 5 Free Payroll Software. 2022 W-4 Help for Sections 2 3 and 4 Latest W-4 has a filing status line but no allowance line.

Web Heres how to calculate it. Ad Get a Payroll Tax Refund Receive Up To 26k Per Employee Even if you Received PPP Funds. Check Our Payroll Software Comparison Charts To find Out Which One Is Most Suited For You.

Make The Switch To ADP. Web The minimum wage in Oklahoma is whatever the minimum wage is at the federal level which is currently 725 per hour. Web Some payroll software services have free payroll tax calculators or build them into their programs.

Approve Payroll When Youre Ready Access Employee Services Manage It All In One Place. Web Free Paycheck Calculator. Ad Payroll So Easy You Can Set It Up Run It Yourself.

Hourly Salary Take Home After Taxes SmartAssets hourly and salary paycheck calculator shows your income after federal state and local taxes. Approve Payroll When Youre Ready Access Employee Services Manage It All In One Place. Get Your Quote Today with SurePayroll.

Tax rates range from. Instead you fill out. Ad Join Thousands Of Other Business Owners Whove Made Their Payroll Management Easier.

Calculate net payroll amount after payroll taxes federal withholding including Social Security. That means that your net pay will be 43803 per year or 3650 per month. Lets Talk ADP Payroll Benefits Insurance Time Talent HR More.

Ad Edit Fill eSign PDF Documents Online. Free Unbiased Reviews Top Picks. It will calculate net paycheck amount that an employee will receive based on the total pay gross payroll.

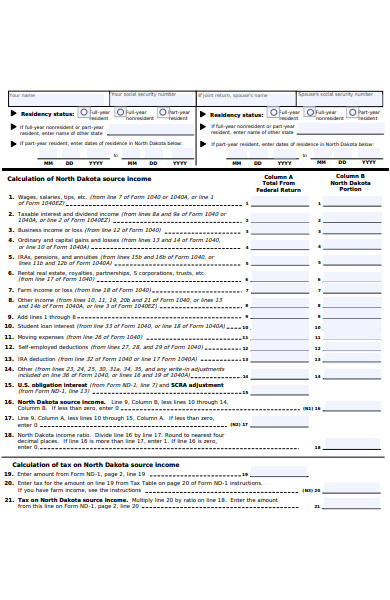

Ad All-In-One Payroll Software Designed To Help Your Company Grow. Web Calculate your Oklahoma state income tax with the following six steps. Be sure to use the state W-4 form when making calculations.

Web Payroll check calculator is updated for payroll year 2023 and new W4. Web Oklahoma Paycheck Calculator. Hourly employees who work overtime.

Web To use our Oklahoma Salary Tax Calculator all you have to do is enter the necessary details and click on the Calculate button. Web 32 payroll tax calculator oklahoma Kamis 16 Februari 2023 Approve Payroll When Youre Ready Access Employee Services Manage It All In One Place. It implies the payroll.

From 9800 to 12200. After a few seconds you will be provided with. Web Oklahoma Salary Paycheck Calculator Gusto The calculators on this website are provided by Symmetry Software and are designed to provide general guidance and.

Web The only state-level tax Oklahoman need to pay is the income tax which ranges from 025 to 475. There are 6 marginal tax brackets applicable on the employees and employers which are based up the taxable income. 2023 ERC Program Eligibiliity Verification - Get Up to 26k Per Eligible Employee.

Web The Oklahoma Salary Calculator is a good calculator for calculating your total salary deductions each year this includes Federal Income Tax Rates and Thresholds in 2023.

Book 2 Pdf Supply Chain Management Supply Chain

Soundcore By Anker Soundcore Sport X10 Bluetooth 5 2 Headphones For Sports Rotating Ear Hooks Deep Bass Ipx7 Water Protection Sweatproof 32 Hours Battery Amazon De Electronics Photo

Best Prestashop Modules For Prestashop 1 7 1 6 Prestashop 1 7 Modules

How Are Payroll Taxes Calculated State Income Taxes Workest

Econ1202 Study Notes Econ1202 Quantitative Analysis For Business And Economics Unsw Thinkswap

How To Calculate Payroll And Income Tax Deductions Peo Human Resources Blog

Oklahoma Income Tax Calculator Smartasset

44 Payroll Templates Pdf Word Excel

Class Of 2013 University Applications Handbook Uwc Maastricht

Economist S View Carbon Taxes Vs Cap And Trade

44 Payroll Templates Pdf Word Excel

Obamacare Optimization Vs Tax Minimization Go Curry Cracker

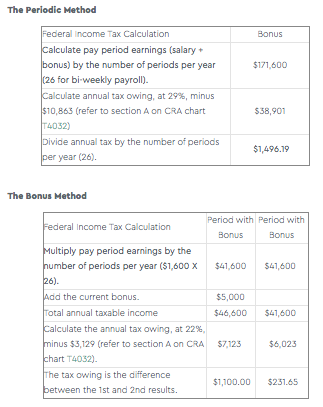

Bonus Pay How To Calculate Work Bonuses And Tax In 2023

Free 7 Sample Payroll Tax Calculator Templates In Pdf Excel

Free 16 Sales Invoice Templates In Ms Word Pdf

The Bonus Tax Method For Payroll Knit People Small Business Blog

Obamacare Optimization Vs Tax Minimization Go Curry Cracker